Does your organization use a probationary period? Do you know the potential impact of this probationary period on your unemployment costs?

A probationary period is defined as a period of time, usually between 30-90 days, during which the employer can assess the employee’s performance, attitude, and overall culture fit while the employee also has the opportunity to evaluate whether the job meets their expectations. If it is determined that the employee is not well-suited for the role, making a decision to part ways during the probationary period can be more straight-forward.

However, in most states, terminating an employee during their probationary period does not relieve the employer of unemployment charges (unless discharged for misconduct). Even so, using a probationary period can help minimize your exposure to unemployment costs when a new hire is not a good fit.

The Basics

Do I have to pay unemployment benefits if I let someone go during the probationary period?

Potentially. While it may be a good business decision, probationary employment does not automatically disqualify a claimant from unemployment. However, you may not be charged for unemployment benefits right away, if ever.

What determines if I have to pay unemployment benefits?

Payment of benefits for any former employee, including one discharged during the probationary period, is based on how the state calculates chargeability using the individual’s base period.

Employers in the base period determine the amount of benefits that an associate can collect based on their earnings and who is chargeable for those benefits. The most recent employer, however, determines eligibility for unemployment benefits.

What is the base period?

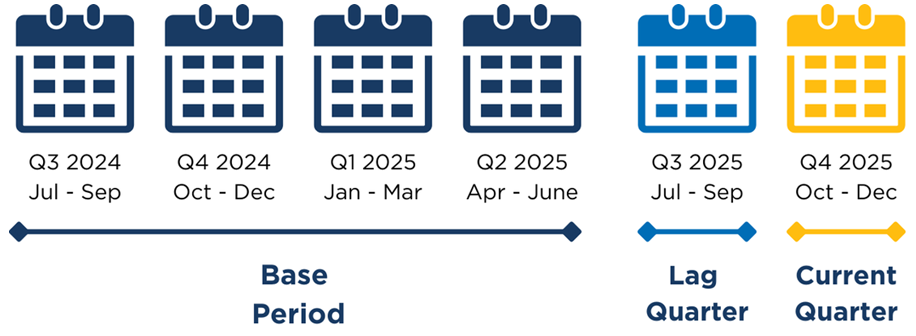

The base period is typically the first four of the last five completed calendar quarters. While some states have alternative ways of calculating the base period, this remains the most commonly used definition.

An Example Scenario

How is the base period calculated?

Let’s say you hire a new employee, John, on October 1, 2025. Your company has a probationary period of 90 days and during that time, you determine that the position is not a good fit for John. You end John’s employment on November 15. John immediately files for unemployment.

As John’s most recent employer, you will receive an unemployment claim asking for separation details. This will determine John’s eligibility for benefits. Any employer who John worked for between July 2024 and June 2025 will be in the base period and, depending on the state law, may be charged for any benefits John receives.

Why are the two most recent quarters not used?

The current calendar quarter (filing quarter) is not used as wages earned during this quarter have not yet been reported to the state. Neither is the most recent prior quarter (lag quarter) as processing of reported wages may still be in progress depending on the claim filing date.

When will I be charged?

As times passes, the wages you paid to an individual will move your organization into their base period. At that time, you may be chargeable for benefits. This is why employers may be chargeable for up to 18 months after an individual’s separation and the retention of documentation is key as memories fade, personnel changes occur but the need for specific details of the separation for a response to the state may still be necessary.

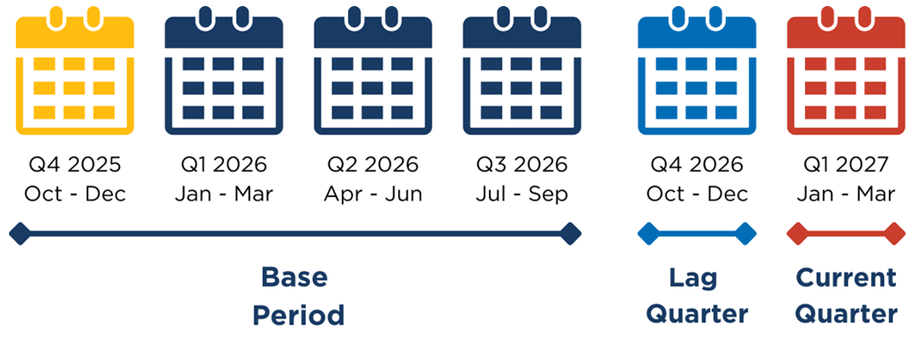

For example, if John starts a new job with Company B on December 1, 2025. If John subsequently files for unemployment anytime between January 1, 2027 and December 31, 2028, his employment with you will fall into the base period. This means that you may be liable for benefits and you will receive a new claim.

Because the claim was received more than 30 days after the separation, we will reach out to your organization to confirm separation details. As a best practice, we reverify the details of a separation when more than 30 days has elapsed from the initial claim to ensure we have the most up to date information. Sometimes people are rehired or additional information becomes available, and since base period claims impact chargeability, we want to have the most current, accurate information for a protest.

As you can see, the potential impact to your account is minimal when you utilize a probationary period. Along with ensuring you have a new hire that is a good fit for your organization, using a probationary period can also help you minimize the liability on these types of unemployment claims and the potential tax costs tied to these claims.

Non-Charge Exceptions

A small number of states have specific provisions in their laws pertaining to probationary period employment that impacts chargeability for tax paying employers. In the following states, an employer will not be chargeable if specific conditions are met:

- Florida – If the claimant is discharged for unsatisfactory performance work during their 90-day probationary period.

- Missouri – If the employer reported the claimant as probationary (worked 28 consecutive days or less).

- Oklahoma – If the claimant was informed of the probationary period within the first 7 work days and was discharged for unsatisfactory performance during an initial 90-day employment probationary period.

- South Dakota – If the claimant was discharged for incompetence or inability and fails to successfully complete a 90-day probationary period.

Best Practices

Even though having a probationary period for new employees does not protect you from potential unemployment benefit charges, it may still be a good business practice. Best practices for establishing a probationary period may include:

- Set a Defined Timeframe Upfront – A new hire needs some time to be fully onboarded, trained, and to get settled in their new role. This may differ from role to role or business to business.

- Communicate Expectations – Explain, in writing, what the probationary period looks like and what they need to accomplish with specific dates.

- Provide Regular Updates – Meet with the new hire on a regular basis to review their progress and actions they need to take to succeed.

- Document Everything – Keep notes from each meeting and be specific about anything that needs to change. This is useful information for protesting an unemployment claim.

- Offer Constructive Feedback – Follow S-B-I (Situation-Behavior-Impact) framework for feedback to offer constructive feedback and not put the new hire on the defensive.

For example:

Situation: On Monday, we had a tour bus stop in at lunch…

Behavior: …you were cleaning up the dining area, but there was a long line and one cashier…

Impact: …which created a long wait time for people to place their orders.

About Us

For more than 40 years, 501(c) Services has been a leader in offering solutions for unemployment costs, claims management, and HR support to nonprofit organizations. Two of our most popular programs are the 501(c) Agencies Trust and 501(c) HR Services. We understand the importance of compliance and accuracy and are committed to providing our clients with customized plans that fit their needs.

Contact us today to see if your organization could benefit from our services.

Are you already working with us and need assistance with an HR or unemployment issue? Contact us here.

The information contained in this article is not a substitute for legal advice or counsel and has been pulled from multiple sources. Some information was provided by our friend, Darby Gibson, Client Marketing & Insights Specialist, at Thomas & Company.

Image by: Mehaniq