Did you know?

501(c)(3) nonprofit organizations can legally opt out of the state unemployment tax program. They can choose instead to reimburse the state only for the unemployment claims of their separated employees.

501(c)(3) nonprofit organizations can legally opt out of the state unemployment tax program. They can choose instead to reimburse the state only for the unemployment claims of their separated employees.

Nearly 86% of 501(c)(3) nonprofits paying state unemployment taxes are overpaying.1

Opting out saves nonprofits an average of 40% per year.2

Over 35% of all 501(c)(3) nonprofits with payrolls over $1 million reimburse their unemployment.3

No more overpaying, pay only your own charges

Say goodbye to fluctuating state tax rates

Insight into your own costs, easier budget forecasting

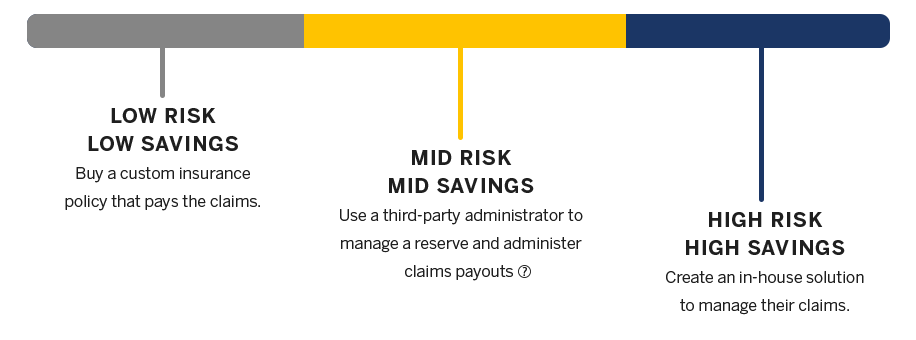

501(c)(3) nonprofits were given the option to fund unemployment benefits outside of their state unemployment insurance program. They have options:

With the demands of fundraising, program management, and administration, nonprofit staff are busy! If you’ve been managing claims in-house, engaging a third-party administrator to handle your unemployment can put valuable time back into your mission.

501(c) Services is devoted to making our clients’ lives easier. We help protest your claims, double-check the state bill, and generally streamline the process.

Employee-owned organization

of experience in offering full-service unemployment outsourcing programs

In 1982 we established the first program in the country to offer a safe, legal way for nonprofits to stop paying the state unemployment insurance tax while still managing unemployment charges for former employees

Client retention rate

Current nonprofit clients

our clients are located around the world

Contact us today to find out how we can help you reimburse your unemployment.