Let’s face it, unemployment compensation is complicated. The many misunderstandings about the program and its purpose can make the process even more complicated. This month, we will tackle some of the most common misconceptions to help you make better decisions when it comes to responding to unemployment claims.

Myth #1 – They Quit Months Ago, The Claimant Can’t File Against Us After All This Time.

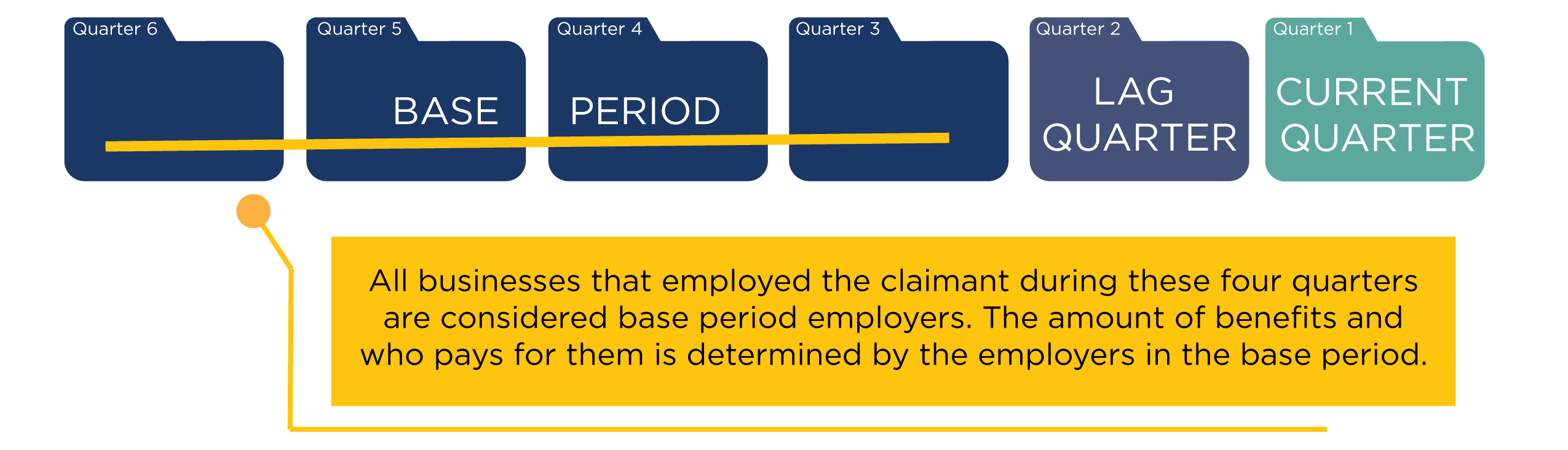

Never take an unemployment claim personally. Even though an individual may not have worked for you in months when you get a claim, they are not filing to get revenge. When an individual files a claim for benefits, any employer they worked for in the past 18 months will be notified. The unemployment process works based on a concept called the base period. This time frame is comprised of the first four of the last five completed calendar quarters. This base period is used to determine the amount of unemployment benefits the claimant can receive. In most states, it is also used to determine which employers are chargeable for benefits should an individual qualify.

As you can see, you may receive a claim for an individual who hasn’t worked for you for some time. It is important that you still respond to those claims with all of the details of the separation. If the state rules in your favor, as a base period employer, the claimant may still qualify for benefits, but your account will not be charged for those benefits.

Myth #2 – I Never Win My Unemployment Cases, So There Is No Point Bothering With a Protest.

The status of employment or the reason for separation has a direct impact on whether or not a case is winnable. We find that when the separation reason is protestable, we can help enhance your chances of winning by making sure that the relevant information is provided to the state. Even with tougher cases like performance or attendance, having the right details and providing those details to the state upfront can make a difference on whether or not it ends in your favor.

If you don’t win the initial claim, there is always an opportunity to appeal the decision at the unemployment hearing level. Our team of experts can help you review the case and offer recommendations so you can decide if it is a case that you want to pursue further. If so, we will work to prepare you and your team for the best possible hearing outcomes.

Myth #3 – The Claimant Paid Into The Program So They Deserve The Benefits.

Many people believe that employees are paying taxes into the unemployment program with each paycheck. That is not true. The employer is actually the one that pays taxes or reimburses the state to fund the unemployment insurance programs when they file their quarterly contribution reports. Most employers pay a tax rate based on how well they manage their unemployment costs (experience) times the taxable wage base in each applicable state. These taxable wage bases can range anywhere from $7,000 to over $67,000, depending on the state. This cost is not shared with the employee. If you are a reimbursing employer, you do not pay quarterly taxes but reimburse the state dollar-for-dollar for any benefits paid.

It is important to note that Alaska, New Jersey, and Pennsylvania do have provisions where taxes (of less than 1%) are withheld from the employee’s paycheck to supplement the unemployment fund.

Myth #4 – Claimants Can Wait For The Perfect Job and Collect Benefits Until They Find It.

Unemployment is designed to be a program that partially replaces an individual’s wages while they are out of work through no fault of their own; in order to qualify for benefits not only are there monetary requirements as described above in the base period, but they also must be able, available and actively seeking work. There is a limit to the number of weeks that an individual can collect. Many states allow up to 26 weeks of benefits, but post-pandemic, there is a trend of tying the duration of benefits to the total unemployment rate in the state. When unemployment is low, like it is today, the duration is shortened to around 12 weeks and the state can increase the number of weeks if unemployment rises.

If you are making job offers to individuals and they turn down a suitable offer of work, their benefits can be terminated or denied. Like with most things related to unemployment, the specific rules of what is a suitable offer will vary from state to state and can change the longer an individual is unemployed. A suitable offer means that the job offers a comparable salary and that the work duties can reasonably be done given the individual’s past experience and training. Any job refusals should be reported to the state if there is an open unemployment claim, and, if the individual is currently collecting benefits, the state will launch an investigation.

Myth #5 – You Shouldn’t Protest Benefits Because You Feel For The Claimant.

It is easy to sympathize with an individual that you may have had to let go. The truth of the matter is that the state is the one that makes the determination on eligibility for the claimant. States need both sides of the story to determine if an individual qualifies for unemployment. By not providing information, you could be slowing down or delaying the payment of benefits. The state makes their determination based on available separation details and state law. If they do not have the necessary information, it could lead to additional work as the state may reach out for this information via a state call, which have short turn-around times.

As you can see, some of the common misconceptions about the unemployment insurance program and its process could have a financial impact on your business. Understanding how the system works is just one step in helping your company control your unemployment costs and save money. Our goal is to partner with you to minimize the risk and exposure in the program, while also making sure that we are not a barrier to those who need and deserve the benefits.

About Us

501(c) Services has more than 40 years of experience helping nonprofits with unemployment outsourcing, reimbursing, and HR services. Two of our most popular programs are the 501(c) Agencies Trust and 501(c) HR Services. We understand the importance of compliance and accuracy, and we are committed to providing our clients with customized plans that fit their needs.

Please contact us today to see if your organization would benefit from our services.

Already working with us and need assistance with an HR or unemployment issue, contact us here.

The information contained in this article is not a substitute for legal advice or counsel and has been pulled from multiple sources. Some information was provided by our friend, Michele Heckmann, Director of Customer Insights, at Thomas & Company.